Don't go chasing whales

Stick to the marlins and groupers

This week, we’re talking:

Landing whale-sized deals might feel good — but it’s not the path to a durable revenue stream 🐳 𓆝 𓆟 𓆞 𓆝 𓆟 🐳

Publishers often treat privacy as a hurdle they need to overcome — what if they embraced it? 🗞 🤝 🔐

Everyone loves a face-off and the Zuckerman v. Zuckerberg lawsuit is delivering 🛜 🚩 🛜

Alex Karp isn’t a household name — here’s why he should be 🤖 🧠 👾

Can we use the Marshall Plan as inspo for a clean energy future? 🗺 🔋 🔌

What everyone is really saying when they’re referencing Orwell 👁️ 👁️ 👁️

My Take:

At my first company, we sold software for algorithmic media monetization, but if you asked me what I did back then, I'd say I mostly hunted whales when I wasn't involved in product and people decisions back at HQ.

I did a 16 million dollar deal with Hewlett Packard. I did a 10 million dollar deal with Microsoft. Like Charlie Sheen, I thought I was #winning. Without even one lesson, I had become an enterprise sales ninja.

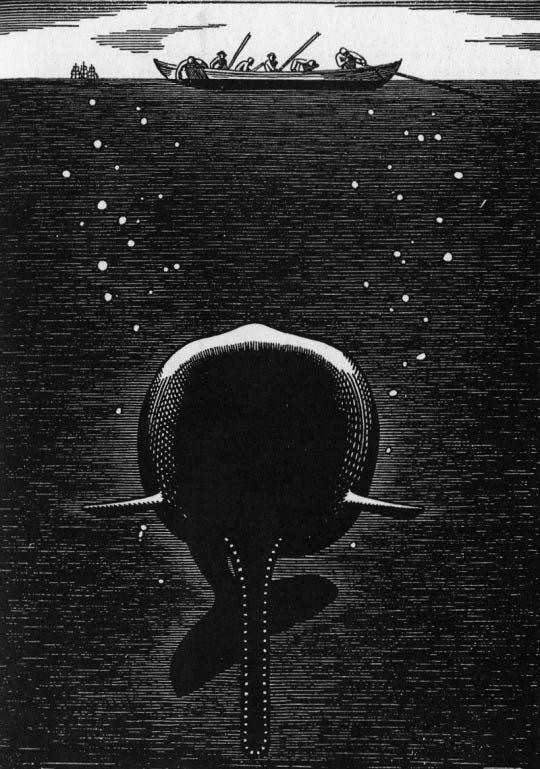

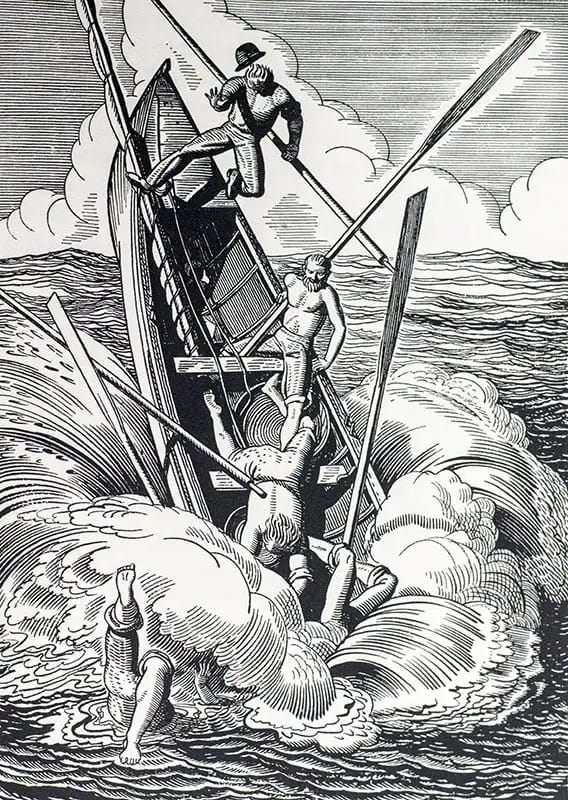

But after each hunt, I was exhausted. You slay the whale, you skin it, you field dress it and the village feeds for two months until the meat starts to turn. And then, it’s back to the boats to hunt again. It was fundamentally unsustainable -- there are only so many whales, and their numbers were dwindling.

It became clear that, to build a more valuable business, we needed to explore a larger ocean where more abundant, more catchable fish lived. At my next company, that became our focus, and we bagged all the $3-500,000 deals we could find.

When I came to understand the benefits of a SaaS model and the scalability challenges of building a durable revenue stream, I told my team I’d take a $50,000 annual recurring deal every day of the week over a slow-moving, sporadic whale. These are what I call Marlins – elegant, fast, and much more plentiful. But to catch one, your boat needs to move fast, and you need to be clever at setting the hook.

I’ve recently come to understand the power and possibility of smaller fish, what I call Groupers. They’re out there in between the rocks in very large numbers. They might not be as majestic, fearsome, and well-known as Moby Dick. They might not be as shimmery as the Marlins photographed in braggadocio fisherman pics.

But there are thousands of them if you’re willing to do the hard work of getting them in the boat. And it turns out that, in the ocean kingdom as in the business world, Groupers can grow to be much bigger than Marlins – they just don’t glisten quite as much.

I learned this lesson, but it's increasingly clear that most in enterprise software salespeople have not. In fact, the majority of enterprise software sellers are completely unaware that the ground has shifted beneath their feet. They sit at the bar bragging about the time they bagged a $2.5M deal at Square or an $8M deal at Morgan Stanley. They remind me of the people from high school who loitered around campus after graduation, reminiscing about the big three-pointer they landed in a finals basketball game or the time they dated the prom queen.

Really, dude? Who cares?

So here’s the memo: If you work in enterprise software sales, you have to orient yourself to the marketplace as it is, not as you’d like it to be. The days of million dollar deals are mostly over. The question you need to ask yourself is: how quickly can you change your field motion, your customer engagement, your pricing and your packaging to meet the market? If you land a whale every once in a while, give yourself a high five! Kill a fatted calf and thank your deity of choice. But remember that chasing cetaceans alone is not a strategy, and if you want to play the game successfully in the long haul, you're going to have to triple your velocity and start chasing the fast-moving marlins, not just the slow, lumbering sperm whales occasionally spotted in deep Arctic oceans.

For enterprise sellers still lusting for olden times, it's time to get with the new, or face imminent extinction.

What I’m Reading:

For News Media, Consumer Data Privacy Shouldn’t Be A Bad Thing (AdExchanger)

Another option, though, is for publishers to remember that their core customers aren’t AI giants, data brokers or advertisers. By repositioning themselves as defenders of consumers’ data dignity, news publishers could strengthen that essential relationship. Taking a forthright pro-consumer stance on issues like transparency and data controls would make it easier for publishers to attract and retain paying subscribers – people who don’t want to get their news from a chatbot and who are willing to pay publishers for reliable, high-quality content.

How a Law That Shields Big Tech Is Now Being Used Against It (NYTimes)

The plaintiff has asked a federal court to declare that a little-used part of Section 230 makes it permissible for him to release his own software that lets users automatically unfollow everyone on Facebook. The lawsuit, filed by Ethan Zuckerman, a public policy professor at the University of Massachusetts Amherst, is the first to use Section 230 against a tech giant in this way, his lawyers said. It is an unusual legal maneuver that could turn a law that typically protects companies like Meta on its head. And if Mr. Zuckerman succeeds, it could mean more power for consumers to control what they see online.

Alex Karp Has Money and Power. So What Does He Want? (NYTimes)

He’s not a household name, and yet Mr. Karp is at the vanguard of what Mark Milley, the retired general and former chairman of the Joint Chiefs of Staff, has called “the most significant fundamental change in the character of war ever recorded in history.” In this new world, unorthodox Silicon Valley entrepreneurs like Mr. Karp and Elon Musk are woven into the fabric of America’s national security.

The Case for a Clean Energy Marshall Plan (Foreign Affairs)

Although today’s challenges are undoubtedly different, the United States should draw lessons from that postwar period and launch a new Marshall Plan, this time for the global transition to clean energy. Just as the Marshall Plan assisted those countries most ravaged by World War II, the new Marshall Plan should aim to help countries most vulnerable to the effects of climate change: the United States’ partners in the developing world. Developing countries and emerging markets will need access to cheap capital and technology to transition away from fossil fuels quickly enough to halt global warming.

Come work with me!

Apply to super{set} VECTOR

A 12-week fully-paid launchpad for technical product leaders to receive direction, build magnitude, and co-explore company creation alongside super{set} - Apply at superset.com/vector