Entrepreneurship from the Trenches

Come for the insights, stay for the stories.

I don’t punch down. I do punch up. I’ve spent the last few years building a fun and healthy presence on LinkedIn — only to see some of my posts criticizing Zuck, Musk and the like to be taken down for “violating community standards.” When I see nonsense, I don’t hold my punches and I need to be on a platform that doesn’t expect me to. So here we are: Tomisms, a weekly newsletter where you can expect trench tales of startup wisdom, thoughts on tech's ethical minefields, and the occasional detour into music, philosophy, and whatever else fuels my curiosity. Whether you’ve stumbled upon this page from following my LinkedIn, listening to The {Closed} Session, hearing about it via super{set} or The Ethical Tech Project grapevine, or if you’re a friend, colleague, mentor, or stranger, welcome! Let’s get started.

The topic for today? Navigating caffeinated valuations in company-building and the value of building in a down market.

In September 1999, when I was a puppy just having closed my first A round (what today would be considered an early-stage Seed), I was invited to a CEO event hosted at Pebble Beach. Dana Carvey was the after-dinner entertainment. Caviar was served. All the captains of industry had their champagne glasses in the air doing the clinky-clinky.

Heady times, and I had no idea what was going on. I only knew that something exciting had happened, and I had mostly missed it

Six months later, I closed a Series A at a valuation much higher than my company deserved by any rational measure, but such were the times. After the crash of 2000, I went to three years of Board meetings packed with investors who were mostly grumpy at themselves for giving me all that money. Four years of hard, hard company-building commenced.

The lesson I drew was that in the future, if the champagne flowed again, I'd go to the party and have a glass, but I wouldn't get schnauckered. I would never believe that I was worth 100X revenue again, no matter who told me that I was. If I was lucky, I'd start building at the bottom, not at a peak, try to catch a wave, and ride it if I could.

I co-founded the next company in late 2009 when markets were still shaking off the debilitating effects of the Great Recession -- as close to a bottom as we were going to find. The end of that journey was an acquisition for 17X revenue in 2016. We worked hard and persisted long enough to enjoy a small bit of luck. I remember something Arthur Patterson, my Board member and long-term mentor, said in one of his many wise moments: “Here’s the thing, Tom: The day after you sell your company, everyone tells you you’re a genius. But the truth is that you’re no smarter, no dumber, than you were the day before.”

Arthur’s dictum still rings true. Its most essential prescription – and I wish more entrepreneurs would heed it – is to maintain your own internal compass and not let an exit or a multiple go to your head.

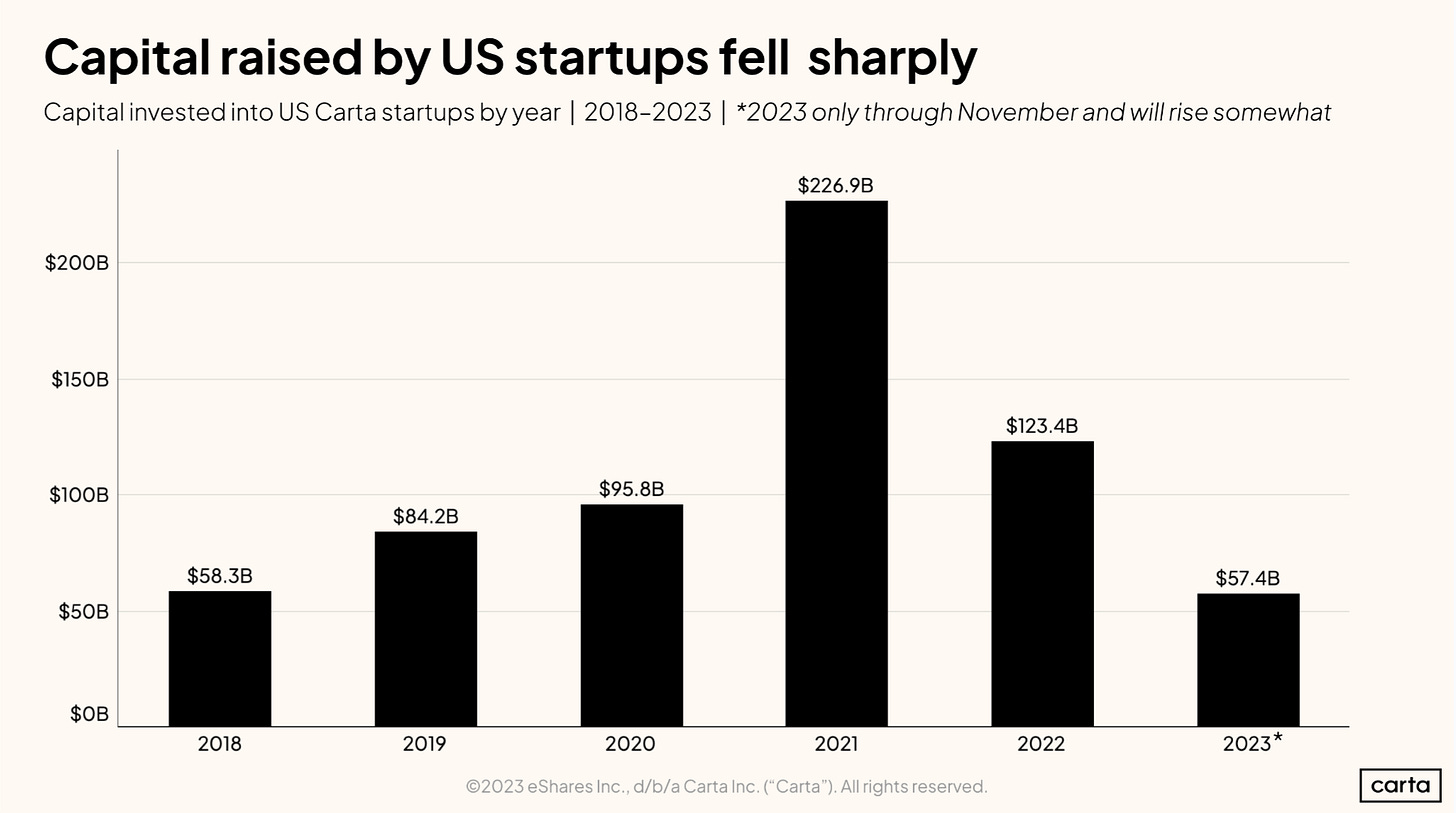

Four years ago, in 2020, when private market SaaS valuations were 22X at the low end, 34X at the median, and 50+X for the high-fliers, 17X looked more like a chump move than a stroke of genius. I didn't believe the 50X then any more than I believed the 100X I got in 2000. The point is, don't tie your sense of professional or moral worth to the numbers. The numbers reflect nothing more than market willingness-to-pay at a moment in time; they're not reliable indicators of the long-term value of the the company you're building.

The point is, don't tie your sense of professional or moral worth to the numbers. The numbers reflect nothing more than market willingness-to-pay at a moment in time; they're not reliable indicators of the long-term value of the the company you're building.

If you're a SaaS company-builder right now, hopefully you didn't drink the kool-aid and take a valuation you have no way of growing into. If you did and you just want to enjoy a good trip, I ain't mad at ya.

If you didn't take a caffeinated valuation, and you're truly committed to the craft of company-building, take a moment to thank your lucky stars that you get to build now at the bottom of a trough. Your next round might happen at a price that's 30% lower than what it might have been two years ago. But five years from now, if and when you land the plane, you won't remember the ignominy of the price you feel you're forced to accept now. The truth is, you won't remember the price at all.

What I’m Reading:

Abortion rights vs Big Tech: A major privacy win against “corporate surveillance” VIA Salon

“In a significant victory for the privacy of people seeking abortion in the U.S., the Federal Trade Commission has issued a groundbreaking ban on the sale of individuals' medical location data.” By Rae Hodge

The Battle for Biometric Privacy VIA Wired

“In 2024, increased adoption of biometric surveillance systems, such as the use of AI-powered facial recognition in public places and access to government services, will spur biometric identity theft and anti-surveillance innovations. Individuals aiming to steal biometric identities to commit fraud or gain access to unauthorized data will be bolstered by generative AI tools and the abundance of face and voice data posted online.” By Joy Buolamwini

News from the Hive:

Super{set} | Super{set} celebrates first exit: LiveRamp to acquire Habu for $200 Million

Fast Company | Why recent legislation falls short on consumer demands for data privacy | Tom Chavez

The Information | The People OpenAI Should Consider for Its New Board | Tom Chavez

The Closed Session | Rachel Gollub on Engineering, Entrepreneurship & Leading Healthcare AI | Podcast