super{set} Closes $90 Million Fund II

We're just getting started.

My Take:

The world has tilted in our favor. We’ve been building companies in the data+AI space for 25 years, mostly while it was niche and nerdy. With the AI revolution fully upon us, we’re thrilled to announce that super{set} has closed a $90 million second fund to invest in companies at inception.

Since launching our first fund, super{set} has founded, funded and scaled 16 data+AI startups. Fund II brings our committed capital in active funds to $176M and comes on the heels of super{set}’s first exit: the acquisition of leading data collaboration company Habu for $200 million in January 2024.

Four years ago, super{set} was just an idea. My fellow Founding General Partner Vivek Vaidya and I had just come off the sale of our company to Salesforce. Many people in our lives assumed we were going to hang up our cleats and just chill to the next episode. Others assumed we’d follow the alleged gold rush and make a play in the crypto/web3 space.

I’d be lying if I said we never considered dabbling in blockchain but experience whispered in the form of our long-term mentor and investor, Arthur Patterson, who famously says, “Specialists beat generalists every time.” Roughly translated: stick to what you’re good at and don’t get distracted by the noise. We love building data+AI companies – “boring but bountiful companies,” as TechCrunch said when we launched. We never thought it was boring but it was fine with us if everyone else did.

Just a few years later, the tide has changed, the world no longer finds our niche so dull. At super{set} we have the playbooks and in-house expertise to accelerate data+AI startup creation. We’re not joining a late-breaking trend; we’ve been doing this for decades.

We only build data+AI companies.

We always have been–and always will be–about the engineering of AI. Meanwhile, much of the current investment and interest is about the science of AI. The difference is this: scientists care about what’s true; engineers care about what works. Machine learning scientists perfecting deep learning models have created a new substrate that we’re ideally equipped to exploit. If GenAI is electricity, think of us as the builders of appliances that use electricity to transform established business processes. Every company in the super{set} portfolio solves a market problem via the application of data to help business users unlock growth, streamline operations, and collapse costs.

We are unabashedly, unapologetically nerdy about data engineering and that is precisely how we differentiate ourselves. Nearly everyone uses the same foundational models. It’s the data that feeds those models that separates us from the herd.

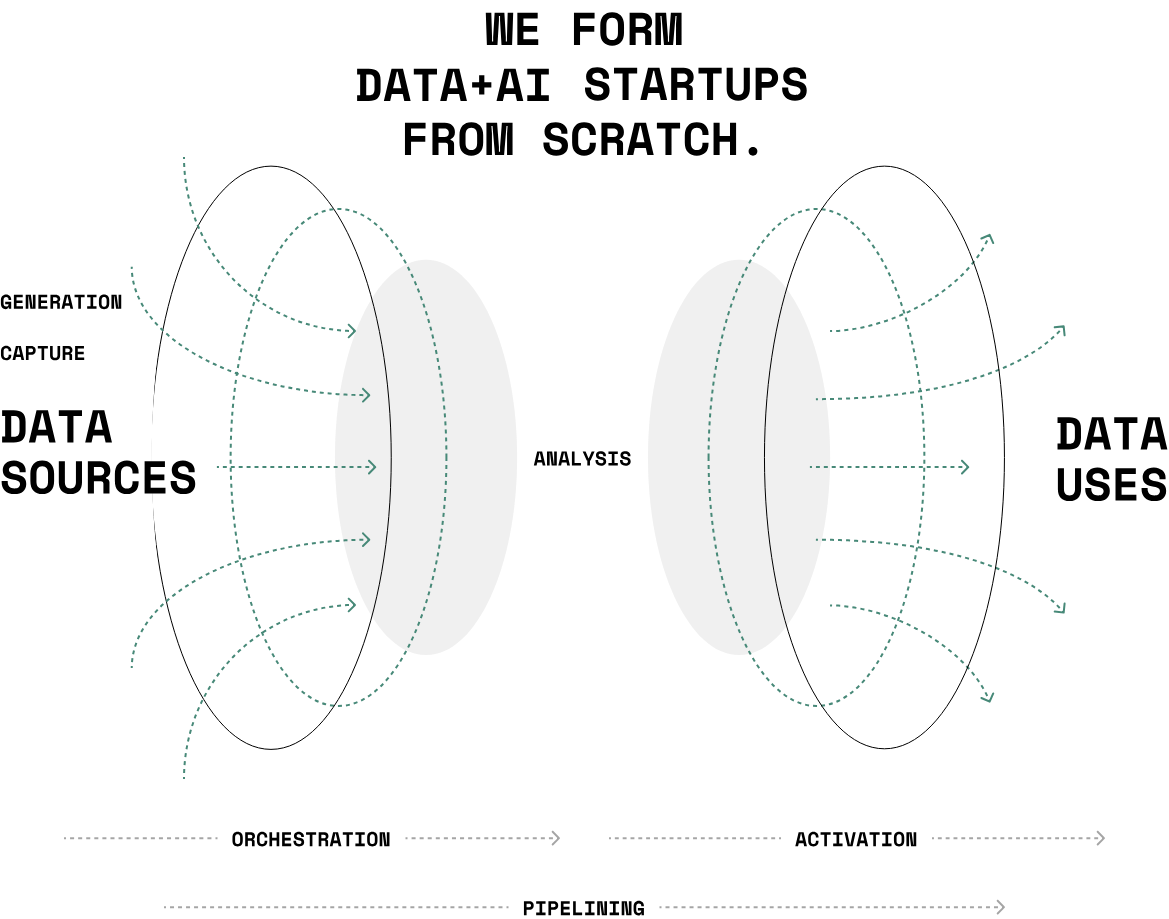

Our companies generate, capture, orchestrate, analyze, and activate data to transform a data source into a data use. After 25 years of building data management solutions, we know some things about creating compelling companies that lead to exits.

We never die in the same ditch twice.

Habu is our first exit out of the gate from Fund I, and success was anything but a straight shot. We pivoted and learned the things not to do, the ditches not to die in, and the shots not to take. Multiply the number of lessons by eighteen - the number of companies I’ve launched in my career - and you can see how we’re in the acceleration phase of our growth curve.

Fund II isn’t just where we double down on what’s working, it’s where we get to avoid all the gutterballs and increase our strikes. With each successive company, we apply the insights of a hundred scars we earned ourselves to keep the cycle of learning and improvement going.

We see company building as a reproducible craft where accumulating knowledge across startups produces stronger outcomes. This means shared infrastructure, replicable go-to-market strategies, best practices for product staging and sequencing, and more. super{set} isn’t just a portfolio of companies that share office space. We’ve built a culture of collaboration – where each company benefits from shared insights and playbooks that meaningfully accelerate and de-risk a startup’s journey.

We invest in people, not pedigree.

Our co-founders range from home-grown heroes to refugees from Big Tech to veterans of early-stage startups. We’re able to look beyond pedigree by writing a People Memo for every hire: a proprietary method that helps us look past the noise and discern the diamonds in the rough.

Regardless of background, all our teams leave ego at the door and work shoulder-to-shoulder with us to build great companies. This people-first performance culture motivates talent, prioritizes mentorship and drives success.

We are united by a belief that there is nothing more fun than solving hard problems alongside teammates that we respect, trust, and enjoy working with. We create the soil conditions for world-class technologists to tackle problems at scale with a committed team of bona fide builders by their side.

The common denominator we look for is an insatiable hunger, gritty perseverance, and demonic intensity. If you have the personality type that leads you to run toward the fire and start building now, chances are you’ve got the psychological makeup to come out the other side and achieve a successful exit.

We’ve already started - join us.

Fund II’s capital will fuel the buildout of the next generation of “boring but bountiful” data+AI companies. We have already started two companies out of Fund II, and we’re only just getting started.

Our mentor, longtime investor, and super{set} LP Arthur Patterson (the co-founder of legendary VC firm Accel) put it like this:

“Tom and Vivek are talented serial entrepreneurs who understand the potential for data and AI to reimagine existing sectors and problem spaces. I’ve watched them create new companies for over two decades, including over the last five years at super{set}. Every super{set} company has their mark: the identification of a clear market need and a proprietary advantage rooted in data. They have demonstrated the ability to build super{set} into a firm that can consistently create important companies, which is why I'm lucky to continue to partner with them.”

We deeply appreciate the confidence of our limited partners who share our vision, and everyone in the super{set} Hive who has committed to building alongside us.

If you think you’ve got the stuff, if you’ve done your one hundred push-ups and are ready to run toward the fire, then come build alongside us at super{set}.

Onward.

Tom

More Reading:

Arthur Patterson on Company Building

A startup factory? $1.2B-exit team launches $65M super{set} by Josh Constine VIA TechCrunch (coverage following launch of Fund I)